skip to main |

skip to sidebar

Courage Under Stressful Conditions When the Outcome is UncertainAll the foreign exchange trading knowledge in the world is not going to help, unless you have the nerve to buy and sell currencies and put your money at risk. As with the lottery “You gotta be in it to win it”. Trust me when I say that the simple task of hitting the buy or sell key is extremely difficult to do when your own real money is put at risk.You will feel anxiety, even fear. Here lies the moment of truth. Do you have the courage to be afraid and act anyway? When a fireman runs into a burning building I assume he is afraid but he does it anyway and achieves the desired result. Unless you can overcome or accept your fear and do it anyway, you will not be a successful trader.However, once you learn to control your fear, it gets easier and easier and in time there is no fear. The opposite reaction can become an issue – you’re overconfident and not focused enough on the risk you're taking.Both the inability to initiate a trade, or close a losing trade can create serious psychological issues for a trader going forward. By calling attention to these potential stumbling blocks beforehand, you can properly prepare prior to your first real trade and develop good trading habits from day one.Start by analyzing yourself. Are you the type of person that can control their emotions and flawlessly execute trades, oftentimes under extremely stressful conditions? Are you the type of person who’s overconfident and prone to take more risk than they should? Before your first real trade you need to look inside yourself and get the answers. We can correct any deficiencies before they result in paralysis (not pulling the trigger) or a huge loss (overconfidence). A huge loss can prematurely end your trading career, or prolong your success until you can raise additional capital.The difficulty doesn’t end with “pulling the trigger”. In fact what comes next is equally or perhaps more difficult. Once you are in the trade the next hurdle is staying in the trade. When trading foreign exchange you exit the trade as soon as possible after entry when it is not working. Most people who have been successful in non-trading ventures find this concept difficult to implement.For example, real estate tycoons make their fortune riding out the bad times and selling during the boom periods. The problem with trying to adapt a 'hold on until it comes back' strategy in foreign exchange is that most of the time the currencies are in long-term persistent, directional trends and your equity will be wiped out before the currency comes back.The other side of the coin is staying in a trade that is working. The most common pitfall is closing out a winning position without a valid reason. Once again, fear is the culprit. Your subconscious demons will be scaring you non-stop with questions like “what if news comes out and you wind up with a loss”. The reality is if news comes out in a currency that is going up, the news has a higher probability of being positive than negative (more on why that is so in a later article).So your fear is just a baseless annoyance. Don’t try and fight the fear. Accept it. Have a laugh about it and then move on to the task at hand, which is determining an exit strategy based on actual price movement. As Garth says in Waynesworld “Live in the now man”. Worrying about what could be is irrational. Studying your chart and determining an objective exit point is reality based and rational.Another common pitfall is closing a winning position because you are bored with it; its not moving. In Football, after a star running back breaks free for a 50-yard gain, he comes out of the game temporarily for a breather. When he reenters the game he is a serious threat to gain more yards – this is indisputable. So when your position takes a breather after a winning move, the next likely event is further gains – so why close it?If you can be courageous under fire and strategically patient, foreign exchange trading may be for you. If you’re a natural gunslinger and reckless you will need to tone your act down a notch or two and we can help you make the necessary adjustments. If putting your money at risk makes you a nervous wreck its because you lack the knowledge base to be confident in your decision making.Patience to Gain Knowledge through Study and FocusMany new traders believe all you need to profitably trade foreign currencies are charts, technical indicators and a small bankroll. Most of them blow up (lose all their money) within a few weeks or months; some are initially successful and it takes as long as a year before they blow up. A tiny minority with good money management skills, patience, and a market niche go on to be successful traders. Armed with charts, technical indicators, and a small bankroll, the chance of succeeding is probably 500 to 1.To increase your chances of success to near certainty requires knowledge; acquiring knowledge takes hard work, study, dedication and focus. Compile your knowledge base without taking any shortcuts, thereby assuring a solid foundation to build upon.

FOREX - the foreign exchange market or currency market or Forex is the market where one currency is traded for another. It is one of the largest markets in the world.Some of the participants in this market are simply seeking to exchange a foreign currency for their own, like multinational corporations which must pay wages and other expenses in different nations than they sell products in. However, a large part of the market is made up of currency traders, who speculate on movements in exchange rates, much like others would speculate on movements of stock prices. Currency traders try to take advantage of even small fluctuations in exchange rates.In the foreign exchange market there is little or no 'inside information'. Exchange rate fluctuations are usually caused by actual monetary flows as well as anticipations on global macroeconomic conditions. Significant news is released publicly so, at least in theory, everyone in the world receives the same news at the same time.Currencies are traded against one another. Each pair of currencies thus constitutes an individual product and is traditionally noted XXX/YYY, where YYY is the ISO 4217 international three-letter code of the currency into which the price of one unit of XXX currency is expressed. For instance, EUR/USD is the price of the euro expressed in US dollars, as in 1 euro = 1.2045 dollar.Unlike stocks and futures exchange, foreign exchange is indeed an interbank, over-the-counter (OTC) market which means there is no single universal exchange for specific currency pair. The foreign exchange market operates 24 hours per day throughout the week between individuals with forex brokers, brokers with banks, and banks with banks. If the European session is ended the Asian session or US session will start, so all world currencies can be continually in trade. Traders can react to news when it breaks, rather than waiting for the market to open, as is the case with most other markets.Average daily international foreign exchange trading volume was $1.9 trillion in April 2004 according to the BIS study.Like any market there is a bid/offer spread (difference between buying price and selling price). On major currency crosses, the difference between the price at which a market maker will sell ("ask", or "offer") to a wholesale customer and the price at which the same market-maker will buy ("bid") from the same wholesale customer is minimal, usually only 1 or 2 pips. In the EUR/USD price of 1.4238 a pip would be the '8' at the end. So the bid/ask quote of EUR/USD might be 1.4238/1.4239.This, of course, does not apply to retail customers. Most individual currency speculators will trade using a broker which will typically have a spread marked up to say 3-20 pips (so in our example 1.4237/1.4239 or 1.423/1.425). The broker will give their clients often huge amounts of margin, thereby facilitating clients spending more money on the bid/ask spread. The brokers are not regulated by the U.S. Securities and Exchange Commission (since they do not sell securities), so they are not bound by the same margin limits as stock brokerages. They do not typically charge margin interest, however since currency trades must be settled in 2 days, they will "resettle" open positions (again collecting the bid/ask spread).Individual currency speculators can work during the day and trade in the evenings, taking advantage of the market's 24 hours long trading day.

What is Forex or Foreign Exchange: It is the largest financial market in the world, with a volume of more than $1.5 trillion daily, dealing in currencies. Unlike other financial markets, the Forex market has no physical location, no central exchange. It operates through an electronic network of banks, corporations and individuals trading one currency for another.

What about Forecasting: Predicting current and future market trends using existing data and facts. Analysts rely on technical and fundamental statistics to predict the directions of the economy, stock market and individual securities.

For those who trade using the Forex, or foreign currency exchange, knowing how to forecast the Forex can make the difference between trading successfully and losing money. When you begin learning about Forex trading, it is vital that you understand how to forecast the Forex trading market.

There are a few methods that are used when forecasting the Forex. Each system is used to understand how the Forex works and how the fluctuations in the market can affect traders and currency rates. The two methods that are most often used are called technical analysis and fundamental analysis. Both methods differ in their own ways, but each one can help the Forex trader understand how the rates are affecting the currency trade. Most of the time, experienced traders and brokers know each method and use a mixture of the two to trade on the Forex.

One method used in forecasting foreign currency exchange is called technical analysis. This method uses predictions by looking at trends in charts and graphs from past Forex market happenings. This system is based on solid events that have actually taken place in the Forex in the past. Many experience Forex traders and brokers rely on this system because it follows actual trends and can be quite reliable.

When looking at the technical analysis in the Forex, there are three basic principles that are used to make projections. These principles are based on the market action in relation to current events, trends in price movements and past Forex history. When the market action is looked at, everything from supply and demand, current politics and the current state of the market are taken into consideration. It is usually agreed that the actual price of the Forex is a direct reflection of current events.

The trends in price movement are another factor when using technical analysis. This means that there are patterns in the market behavior that have been known to be a contributing factor in the Forex. These patterns are usually repeating over time and can often be a consistent factor when forecasting the Forex market. Another factor that is taken into consideration when forecasting the Forex is history. There are definite patterns in the market and these are usually reliable factors. There are several charts that are taken into consideration when forecasting the Forex market using technical analysis. The five categories that are look at include indicators, number theory, waves, gaps and trends.

Most of these can be quite complicated for those who are inexperienced using the Forex. Most professional Forex brokers understand these charts and have the ability to offer their clients well-informed advice about Forex trading.

Another way that experienced brokers and traders in the Forex use to forecast the trends is called fundamental analysis. This method is used to forecast the future of price movements based on events that have not taken place yet. This can range from political changes, environmental factors and even natural disasters. Important factors and statistics are used to predict how it will affect supply and demand and the rates of the Forex. Most of the time, this method is not a reliable factor on its own, but is used in conjunction with technical analysis to form opinion about the changes in the Forex market.

For those interesting in being involved with Forex trading, a basic understanding of how the system works is essential. Understanding both forecasting systems and how they can predict the market trends will help Forex traders be successful with their trading. Most experienced traders and brokers involved with the Forex use a system of both technical and fundamental information when making decisions about the Forex market. When used together, they can provide the trader with invaluable information about where the currency trends are headed.

Always leave the forecasting to the pros unless you are playing the Forex as a hobby and don’t have a lot of money invested…Or like most people you will learn the hard way.

Forex Trading Methods - Day Trading

What is Day Trading?

Day trading refers to the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close of the trading day. This can occur in any marketplace but is most common in the foreign exchange market and stock market. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. However, with the advent of electronic trading and margin trading, day trading has become increasingly popular among casual, at home traders. Day traders utilize high amounts of leverage and short-term trading strategies to capitalize on small price movements in highly liquid stocks or currencies. They serve two critical functions in the marketplace - keeping the markets running efficiently via arbitrage and providing much of the markets' liquidity.

Trade Frequency

Although collectively called day trading, there are many styles within day trading. A day trader is actively searching for potential trading setups (that is, any stock or other financial instruments that, in the judgment of the day trader, is in a tension state, ready to accelerate in price in either direction, that when traded well has a potential for a substantial profit). The number of trades you can make per day are almost unlimited, as are the profits and losses.

Some day traders focus on very short-term trading within the trading day, in which a trade may last just a few minutes. Day traders may buy and sell many times in a trading day and may receive trading fee discounts from their broker for this trading volume.

Some day traders focus only on price momentum, others on technical patterns, and still others on an unlimited number of strategies they feel can be profitable. Some day traders exit positions before the market closes to avoid any and all unmanageable risks - negative price gaps (differences between the previous day's close and the next day's open bull price) at the open - overnight price movements against the position held. Other traders believe they should let the profits run, so it is acceptable to stay with a position after the market closes.

Day traders sometimes borrow money to trade. This is called margin trading. Since margin interests are typically only charged on overnight balances, the trader pays no fees for the margin benefit, although they still run the risk of a Margin call.

Profit and Risks

Because of the nature of financial leverage and the rapid returns that are possible, day trading can be either extremely profitable or extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Some day traders manage to earn millions per year solely by day trading.

Because of the high profits (and losses) that day trading makes possible, these traders are sometimes portrayed as "bandits" or "gamblers" by other investors. Some individuals, however, make a consistent living from day trading.

Nevertheless day trading can be very risky, especially if any of the following is present while trading:

- trading a loser's game/system rather than a game that's at least winnable,

- trading with poor discipline (ignoring your own strategy, tactics, rules),

- inadequate risk capital with the accompanying stress of having to "survive",

- incompetent money management (i.e. executing trades poorly).

The common use of buying on margin (using borrowed funds) amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. In addition, brokers usually allow bigger margins for day traders. Where overnight margins required to hold a stock position are normally 50% of the stock's value, many brokers allow pattern day trader accounts to use levels as low as 25% for intraday purchases. This means a day trader with the legal minimum $25,000 in his or her account can buy $100,000 worth of stock during the day, as long as half of those positions are exited before the market close. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than his or her original investment, or even larger than his or her total assets.

The Controversy

The profit potential of day trading is perhaps one of the most debated (and misunderstood) topics on Wall Street. Countless internet scams have capitalized on this confusion by promising enormous returns in a short period. Meanwhile, the media continues to promote this type of trading as a get-rich-quick scheme that always works. The truth lies somewhere in the middle. There are those who engage in this type of trading without sufficient knowledge (or some even admittedly for a gambler's high). However, there are day traders who are able to make a successful living. Many professional money managers and financial advisors shy away from day trading, arguing that in most cases the reward does not justify the risk. They often cite that no day trader is world renown, whereas icons like Warren Buffett and Peter Lynch are a testament to the success that can be attained by more traditional forms of investing. Conversely, those who do day trade insist there is profit to be made. They say the success rate is inherently lower as a result of the higher complexity and necessary risk of day trading, combined with all the related scams. Overall, the street remains divided on the issue. At the very least they agree that day trading is not for everyone and involves significant risks. Moreover, it demands an in-depth understanding of how the markets work and various strategies for profiting in the short term.

Day Trading For A Living

There are two primary divisions of professional day traders: those who work alone and/or those who work for a larger institution. Most day traders who trade for a living work for a large institution. The fact is these people have access to things individual traders could only dream of: a direct line to a dealing desk, large amounts of capital and leverage, expensive analytical software and much more. These traders are typically the ones looking for easy profits that can be made from arbitrage opportunities and news events. The resources to which they have access allow them to capitalize on these less risky day trades before individual traders can react. Individual traders often manage other people's money or simply trade with their own. Few of them have access to a dealing desk; however, they often have strong ties to a brokerage (due to the large amounts of commission spending) and access to other resources. However, the limited scope of these resources prevents them from competing directly with institutional day traders, instead, they are forced to take more risks. Individual traders typically day trade using technical analysis and swing trades, combined with some leverage, to generate adequate profits on such small price movements in highly liquid stocks.

Day trading demands access to some of the most complex financial services and instruments in the marketplace. Day traders require:

1. Access to the Trading Desk

This is usually reserved for traders working for larger institutions or those who manage large amounts of money. The dealing desk provides these traders with instantaneous order executions, which can become important, especially when sharp price movements occur. For example, when an acquisition is announced, day traders looking at merger arbitrage can get their orders in before the rest of the market, taking advantage of the price differential.

2. Multiple News Sources

In the move "Wall Street" Gordon Gekko says that 'information is the most important commodity when trading’. News provides the majority of opportunities day traders capitalize on, so it is imperative to be the first to know when something big happens. The typical trading room contains access to the Dow Jones Newswire, televisions showing CNBC and other news agencies, as well as software that constantly analyzes various other news sources for important stories.

3. Analytical Software

Trading software is an expensive necessity for most day traders. Those who rely on technical indicators or swing trades rely more on software than news.

Combined these tools provide traders with an edge over the rest of the marketplace. It is easy to see why, without them, so many inexperienced traders lose money.

Techniques

The following are several basic strategies by which day traders attempt to make profits. Besides these, some day traders also use contrarian (reverse) strategies (more commonly seen in algorithmic trading) to trade specifically against irrational behavior from day traders using these approaches.

Some of these approaches require shorting stocks instead of buying them normally: the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, some short sales can only be made if the stock price or bid has just risen (known as an "uptick"), and the broker can call for the return of its shares at any time. Some of these restrictions (in particular the uptick rule) don't apply to trades of stocks that are actually shares of an exchange-traded fund (ETF).

1. Trend Following

Trend following, a strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. The trend follower buys an instrument which has been risin,g or short-sells a falling one, in the expectation that the trend will continue.

2. Contrarian Investing

Contrarian investing is a market timing strategy used in all trading time-frames. It assumes that financial instruments which have been rising steadily will reverse and start to fall, and vice versa with falling. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change.

3. Range Trading

Range trading is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. That is, every time the stock hits a high, it falls back to the low, and vice versa. Such a stock is said to be "trading in a range", which is the opposite of trending. The range trader therefore buys the stock at or near the low price, and sells (and possibly short sells) at the high. A related approach to range trading is looking for moves outside of an established range, called a breakout (price moves up) or a breakdown (price moves down), and assume that once the range has been broken prices will continue in that direction for some time.

4. Scalping

Scalping was originally referred to as spread trading. Scalping is a trading style where small price gaps created by the bid-ask spread are exploited. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Scalping highly liquid instruments for off the floor day traders involves taking quick profits while minimizing risk (loss exposure). It applies technical analysis concepts such as over/under-bought, support and resistance zones as well as trend line, trading channel to enter the market at key points and take quick profits from small moves. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands.

5. Rebate Trading

Rebate Trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue, considering the payment structure of ECN paying per share. Traders maximize their returns by trading low priced, high volume stocks. This enables them to trade more shares and have more liquidity with a set amount of capital.

6. News Playing

News playing is primarily the realm of the day trader. The basic strategy is to buy a stock which has just announced good news, or short sell on bad news. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits (or losses). Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. The most common cause for this is when rumors or estimates of the event (like those issued by market and industry analysts) were already circulated before the official release, and prices have already moved in anticipation---the news is already priced in the stock.

Conclusion

Although day trading has become somewhat of a controversial phenomenon, its prevalence is undeniable. Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. Some argue that individuals should stay away from day trading, while others argue that it is a viable means to profit. And although it is becoming increasingly popular among inexperienced traders, it should be left primarily to those with the skills and resources needed to succeed.

Money Management in Forex: the Real Deal in Trading

In comparison to the amount of time, money and energy spent by some traders on Forex robots, error-proof technical strategies, and quasi-magical foreign exchange trading courses where we are promised to be made super-traders, it is a pity that money management receives insufficient attention. Although almost every trader worthy of the title is aware that success in Forex is largely dependent on careful management of losses, as well as profits, this aspect of trading is somewhat neglected in preference to indicators, statistics, analysis and strategy. Yet the first issue faced by a beginning trader is losing money while trading, and strategy or analysis doesn't say much about how to cope with it. As such, careful study and practice of money management methods must be paramount in the mind of the trader who is committed to achieving success in trading Forex.

What is analysis? It is the identification of high probability scenarios for profits. Probability does not involve any certainty, and by definition, any analytical scenario, however solid it may be, will lead to losses sooner or later. In the case of the beginner, whose skills are underdeveloped in best cases, and undeveloped in the worst, losses will come a lot sooner than profits. It is clear, then, that any trader's education must begin with a good understanding of the importance and necessity of money management skills.

Money management teaches us how to manage losses, and how to maximize profits. It all commands us to cultivate a responsible and disciplined attitude to trading by acquiring consistency in our habits. We are taught not to be erratic in trade sizes, to be consistent about the entry of stop loss or take profit orders, and above all, to regard loss as a natural, and indeed, inseparable part of a trading career. There are many ways of managing loss, but there is no way of avoiding it altogether in a trading career. Even George Soros has had a number of serious, sometimes massive blunders in his long career, but he is still regarded as a master trader by many. Warren Buffet bought the shares of an oil company at the peak of the oil bubble in 2008, and he made wrong choices with Salomon Brothers in the 90's as well. But all these traders were quick to recognize errors, and mange losses instead of denying them and letting them fester and achieve huge proportions. What happens to those who refuse to accept losses, and choose to add to them with the hope of eventual gains is obvious in the case of Nick Leeson and Jerome Kerviel, one of who bankrupted a U.K. bank, and the other lost $7 billion. Both went to jail eventually.

So money management is the heart and soul of trading, the safety valve against errors, and the shield against fear and irrationality. Forex trading brokers may give you the tools of technical analysis and tens of indicators, but money management skills can only be acquired by diligent and patient practice, and a total commitment to success in trading. On the other hand, a master of money management is a master trader, and it is but a matter of time before he perfects his skills in analysis and strategy and acquires the great riches which he deserves.

Stock markets world over are considered to be the best earner of the returns on the money. That said not everybody who invests in the stock markets becomes rich like Warren Buffet . However millions of people have become rich to some extent by the stock markets or at least they have earned above average returns on the money they invested.

Next is the issue of getting your feet wet in the stock markets before you take the plunge into the choppy waters of the stock markets. The best advice they have given on the stock markets is that it is not for the faint hearted. Also, the other advice is that stock markets carry more risk than any other type of investments but as they say higher the risk higher the gain. If you need to learn about the functioning of the stock markets then your best bet is to actually trade yourself. Your next step should be to open up an account at either an on-line trading company or brokerages or go to a full service broker which can guide through the whole investment process.

If want to learn the stock market without the hassles opening up a brokerage account then your best bet is to buy a stock market simulator software or a stock market basics learning DVD which can teach a few basics about the stock market without investing in the stock market.

Another factor to consider while learning the stock market is that you have to be very cautious in the early stages so as to learn the basics and not make any big gambles on the market. Those gambles and making huge bets that you hear people made and got huge amounts of profits will come later once you have got perfection in the art of picking the right stocks

Charts are the most fundamental aspect upon which the world of Forex technical analysis is based. There are several ways to display price charts. However, the selection of the specific chart depends on the analyst in question, and his or her preference as to which chart provides the best signal at the earliest stage. It is also important to note that some forex brokers offer charts as part of their trading platform, while others do not.

Line chart

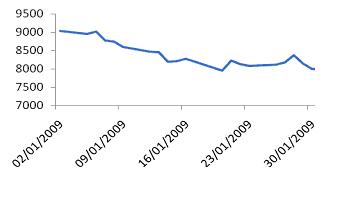

The line chart is the simplest chart. The Y-axis represents time whereas the X-Axis displays the price. We can plot the position of the market per minute, hour, 15 minutes, daily, or a weekly bases. This kind of chart only shows the closing price over a period of time. A line chart does not provide additional information such as high, low, and opening price. The greatest benefit to the analyst of a line chart is its simplicity and the ability to understand price movements very easily. A line chart also depicts trends by simply viewing its slope.

Bar chart

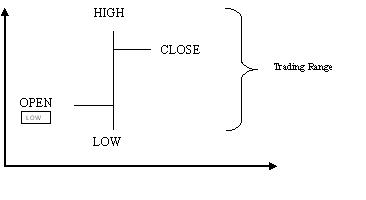

The Bar chart uses vertical bars to display price action for a particular day with the help of a line from the lowest to the highest price as shown below. The bar represents the day’s high, low, and closing price. Bar charts allow traders to see patterns easily. The bar chart is a set of four prices for a given day, hence it is also referred to as a price bar.

Candlesticks

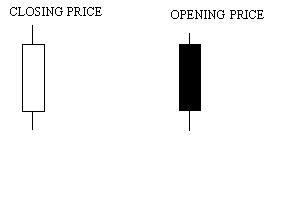

The candle stick chart is similar to a bar chart but differs in the way that it is visually constructed. The chart is plotted over a one day, weekly, as well as monthly period as it gives a detailed picture of longer time price action. The chart displays a thick body called the real body and a line extending above and below called the upper and the lower shadow. The top of the upper shadow represents the high price and the bottom of the lower shadow represents the low price. The opening and closing values depend on the color of the chart. If the color of the chart is black, it means the top is the opening value, and if it is white then the top represents the closing value. The white body of the chart indicates bullishness and the black body represents bearishness.

Point and figure chart This type of chart is rarely used in forex analysis. This chart plots day to day increases and declines in the price of a currency vis-à-vis another currency. A rising X represents increase in currency value whereas a declining O represents decrease in the currency value. This kind of chart is typically used by the traders for intraday charting and estimation.

Three Line break chart

This chart displays a series of vertical boxes that reflect changes in currency prices. The method is so named because of the number of lines typically used. Each line may indicate buy, sell, and trend of the market. The basic application of this method is to buy when a white line appears after three adjacent black lines and sell when a black line appears after three adjacent white lines.

Conclusion: There are various charts for technical analysis out there, although the most commonly used charts are candlesticks, line charts, and bar charts. Each comes with its advantages and drawbacks, although each chart can be used as the result of personal preference or perceived accuracy.